Introduction to National Income Accounting

National Income Accounting or NIA refers to methods or techniques used to measure the economic activity in a national economy as a whole. As one can calculate income for a single person or an entity, the same can be done for a country also.

In an economy, households buy goods and services from firms, and firms use their revenue from sales to pay wages to workers, rent to landowners, and profit to firm owners. GDP equals the total amount spent by households in the market for goods and services. It also equals the total wages, rent and profit paid by firms in the markets for the factors of production.

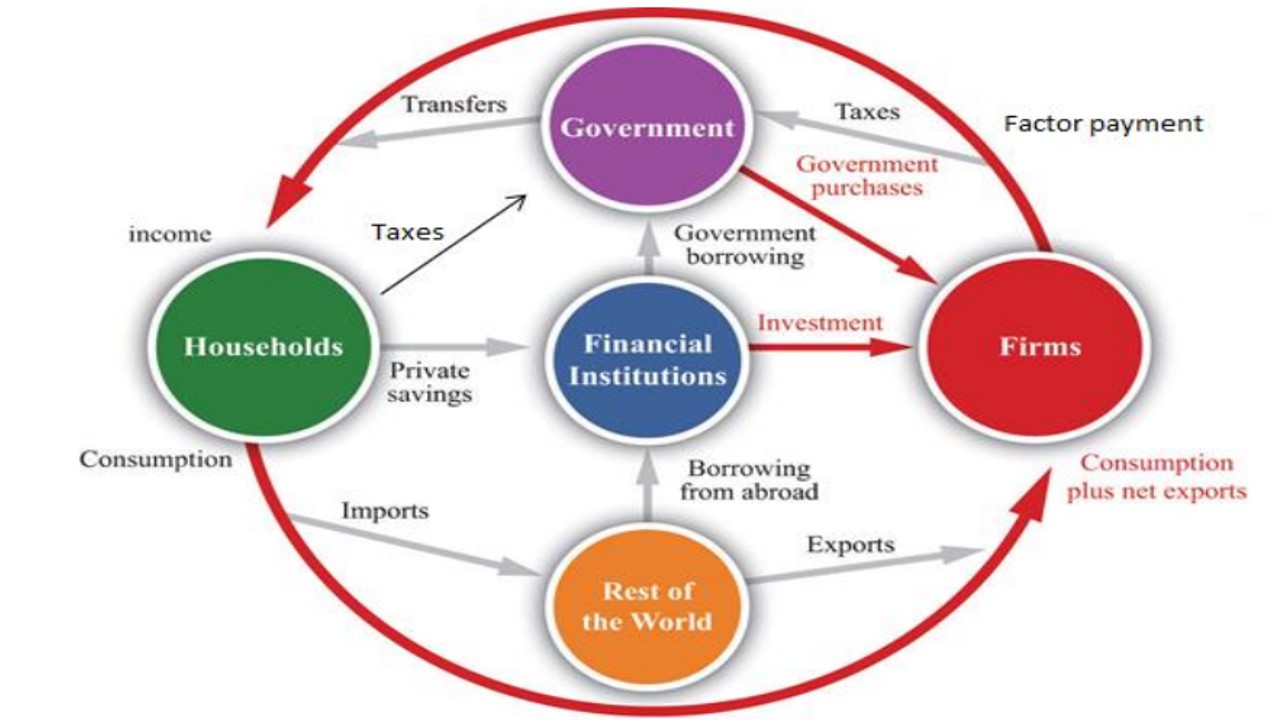

The following Circular Flow Diagram shows the flow of resources (money) in an open economy:

The diagram describes all the transactions between households and firms in a simple economy.

It simplifies matters by assuming that all goods and services are bought by households and that households spend all of their income.

Money continuously flows from households to firms and then back to households.

GDP measures this flow of money. It can be computed for an economy in one of the following ways:

• By adding up the total expenditure by households (Expenditure Method)

• By adding up the total income (wages, rent, profit) paid by firms (Income Method)

• By adding up the total value of all final goods and services produced in the economy (Output / Value Added Method)

Since all expenditure in the economy ends up as someone’s income, GDP is the same regardless of how we compute it.

Significance of National Income Accounting

• International Comparison: National Income Accounting measures growth rate and development of nations, which can be used to compare standard of living of different countries.

• Business Decisions: It reflects the relative contribution and potential of various sectors of the economy which guides the business class to plan for future production.

• Policy Formulation: It throws light on the distribution of income and resources in the economy, which helps government in proper allocation of resources to bring equality and development in nation.

• Policy Evaluation: The income accounting identifies specific economic achievements and failures which helps people of the nation in evaluating the policies of the government.

• Annual Budget: It shapes the budgetary policy of the Government, makes the borrowing and tax policy in order to neutralize the fluctuations of income and employment. The government takes to deficit or surplus budget to arrest depression or inflation in an economy.

• National statistics gives clear picture of how the national expenditure is divided into investment and consumption.